Bank Nifty Share price target | Nifty prediction for 10 Feb

Today’s market updates || Nifty Prediction & Bank Nifty Share price target for 10 Feb 2021

Nifty Prediction & Bank Nifty Share Price target for 10 Feb: Indian equity markets opened positive today in line with the global peers. Positive cues from other Asian markets helped the key indices to maintain their gaining momentum most of the day. Indian markets expanded their early gains in the late morning and later in the last half an hour, it erased all intraday gain and closed marginally lower.

Traders noted the reports of securitization volumes halved to Rs 24,400 crore during the December quarter compared to the year-ago period. But it showed a healthy 61% rise over the preceding September quarter. Domestic rating agency ICRA said it maintains that overall volumes of securitization, where a lender sells down its loans portfolio or futures receivables to investors at a discount for upfront payment will come at up to Rs 90000 crore in FY2020-21, as against rarely Rs 1.90 lakh crore in FY2019-20.

On the global front, Asian markets closed higher on Tuesday in line with a broader rally as volumes remained thin ahead of the Lunar New Year holidays. European markets are trading lower after a recent rally on hopes of global economic recovery and vaccine rollout. The US market futures indices are trading marginally lower at this time ( 4.50 pm IST)

Today’s market updates- Sensex, Nifty, and Bank Nifty

At the close. Nifty fell 6.50 points or 0.04% and at 15109.30 levels while Sensex declined 19.69 points or 0.03% and closed at 51329.08 levels. The Bank Nifty share price was trading volatile today. The Bank Nifty spot price gained 72.85 points or 0.21% and ended at 36 056.50 levels.

The Nifty midcap and smallcap indices closed marginally lower today. The midcap index fell 17.55 points or 0.08% and at 22747.40 levels. The smallcap index declined 35.85 points or 0.46% and closed at 7717.45 levels.

The top five gainers in the Nifty50 index for the day were Asian Paints, SBI Life, HDFC life, ONGC, and Titan Company. The top five losers in the Nifty50 index were IOC, M&M, Tata Motors, JSW Steel, and Bajaj Auto. The most active stocks in the Nifty50 index for the day were Tata Motors, SBI, and Tata Steel.

On a sectoral front, Insurance, Telecom, Manufacturing, Chemical, and Infrastructure sectors closed higher. The sectors that closed in the red are Automobiles, Healthcare, Metals, IT & Software, and FMCG.

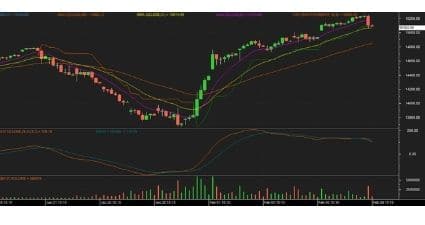

Nifty & Bank Nifty futures price today

The Nifty futures share price opened at 15153 made a positive opening of 26.5 points. It has touched an intraday high at 15266 and a day’s low at 15062.40

The Nifty futures share price has given a movement of 203.6 points. In the end, it fell 22.5 points or 0.15% and closed at 15104 levels.

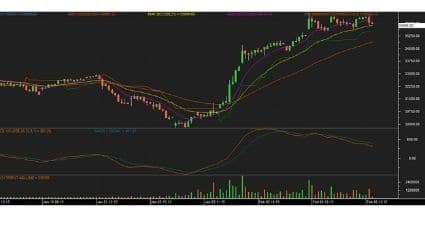

The Bank Nifty futures share price opened at 36580 It made a positive opening of 566.2 points today. It has touched an intraday high at 36580 and a day’s low at 35639

During the day, the Bank Nifty futures share price has given a movement of 941 points. In the end, it closed marginally lower by 15.8 points or 0.04% and closed at 35998 levels.

Nifty prediction and Bank Nifty share price target in futures for 10 Feb ( Feb Expiry)

Nifty futures prediction for 10 Feb 2021

Primary Nifty Trend in futures: Positive

Range-Bound Trend of Nifty Futures: All up Moves Initiates Profit Booking (Sale) @ 15220 whereas All Down Moves Initiates Short Covering (Buy) @ 15020

If the Nifty futures share price Moves Above 15155 and sustain. Then you should Buy with 1st Target of 15185 during the day with a Stop Loss of 15070 FOR the Target of 15185-15226- 15276

If the Nifty futures share price Moves Below 15070 and sustain. Then you should Sell with the 1st Target of 15026 during the day with a Stop Loss of 15155. FOR the Target of 15026- 14985 -14945

Bank Nifty share price target in futures for 10 Feb 2021

Primary Trend of Bank Nifty Futures: Positive

Range-Bound Trend of Bank Nifty Future: All up Moves Initiates Profit Booking (Sale) @ 36300, whereas All Down Moves Initiates Short Covering (Buy) @ 35350

Suppose Bank Nifty futures share price Moves Above 36150 and sustain. Then you should Buy with the 1st Target of 36280 during the day with a Stop Loss of 35890. FOR the Target of 36280 – 36505- 36730

If the Bank Nifty futures share price Moves Below 35890 and sustained. Then you should Sell with the 1st Target of 35775 during the day with a Stop Loss of 36150. FOR the Target of 35775 – 35565- 35350

Conclusions:

The Indian market pauses after six days of the rally. The key benchmark started the day with an optimistic note but at the close, heavy selling pressure erased all intraday gains and closed the markets marginally lower. Bank nifty share price traded volatile today and in the end, it closes marginally higher.

The market is looking positive but we may expect a small correction in the coming days.Traders/investors can follow our Daily Morning market views and can follow our Nifty prediction and Bank Nifty share price target in futures for 10 Feb 2021.

Also read, Stock recommendations- Top 3 Stock Picks for next week

Nifty | Bank Nifty futures prediction for the week (8-12 Feb)

If you like the post please share it with your friends and others

Happy Investing!

Editor’s Desk

Disclaimer-

Nifty50Stocks.com has taken due care and caution to compile the data for its Website. The views and investment tips expressed by investment experts on Nifty50Stocks.com are their own and not that of the website or its management. Nifty50Stocks.com is not SEBI registered Advisors and advises its users to check with certified and SEBI registered experts before taking any investment decision. However, Nifty50Stocks.com does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or the results obtained from the use of such information. Nifty50Stocks.com especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.