Nifty | Bank Nifty futures prediction ahead of F&O expiry

Key factors that may impact the markets next week || Nifty and Bank Nifty futures prediction ahead of F&O expiry

Nifty & Bank Nifty futures prediction next week: The Indian stock markets closed lower during the week. The key benchmark indices Sensex & Nifty declined by 1.27% and 1.19% respectively while Bank Nifty was down 0.74% in the week ended 19 February. The Nifty midcap and smallcap indices outperformed the benchmark indices during the week. The profit booking was seen in the market due to negative global market cues and the absence of any major events.

The factors that may impact the Indian stock market indices Nifty and Bank Nifty futures in the next week are as follows:

Economic data

The GDP number of the December end quarter is expected to be released next week on Friday. Analysts are expecting India’s GDP to return to growth in Q3 FY2020-21 (October-December 2020), after contracting for two quarters. There are research houses that already forecasted Indian Q3 GDP will rise 0.7-0.8 percent.

GDP numbers can be the next trigger for the Indian stock market to set the market direction. Traders should remain cautious ahead of the GDP data announcement. Other than GDP numbers the economic data that are schedule for the next week are:

| Macro Data Next Week | |

| 26 Feb 2021 | Infrastructure output |

| 26 Feb 2021 | Deposit & Bank Loan growth |

| 26 Feb 2021 | GDP Growth rate |

| 26 Feb 2021 | Foreign Exchange reserve |

Nifty and Bank Nifty futures prediction ahead of F&O expiry

Nifty futures prediction for the week ( 22-26 Feb)

Primary Trend of Nifty futures for the week: Negative

Range-Bound Trend of Nifty futures: All up Moves Initiates Profit Booking (Sale) @ 15070 whereas All Down Moves Initiates Short Covering (Buy) @ 14900

If Nifty share price in futures Moves Above 15035 and sustain. Then you should Buy with 1st Target of 15075 during the day or week with a Stop Loss of 14975 FOR the Target of 15075- 15122- 15170- 15205

Suppose Nifty share price in futures Moves Below 14975 and sustain. Then you should Sell with the 1st Target of 14946 during the day or week with a Stop Loss of 15035. FOR the Target of 14946- 14900- 14880-14830

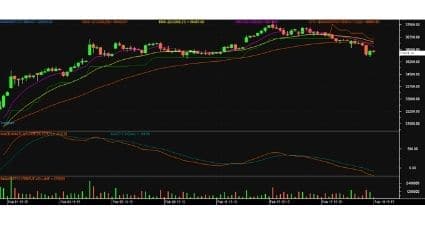

Bank Nifty futures prediction for the week ( 22-26 Feb)

Primary Trend of Bank Nifty future for the week: Negative

Range-Bound Trend of Bank Nifty share price in future: All up Moves Initiates Profit Booking (Sale) @ 36500, whereas All Down Moves Initiates Short Covering (Buy) @ 34900

If Bank Nifty share price in the futures Moves Above 36140 and sustain. Then you should Buy with the 1st Target of 36290 during the day with a Stop Loss of 35730. FOR the Target of 36290 – 36510- 36850- 37170

If Bank Nifty shares price in the future Moves Below 35730 and sustained. Then you should Sell with the 1st Target of 35430 during the day with a Stop Loss of 36140. FOR the Target of 35430- 35190- 34940 – 34400

Global market cues

Most of the global stock markets closed higher during the week. The US markets opened higher on Tuesday after a long weekend and traded with the hopes of further fiscal stimulus, continued the easy monetary policy, better than expected corporate earnings, and progress in fighting the coronavirus. The profit booking seen in the US markets due to inflation worries and increase in jobless claim.

European markets mostly gained during the week due to encouraging quarterly earnings, ease of lockdown, slowed contraction of economic data. Japanese and Chinese stock markets closed also closed higher during the week.

Traders need to follow the global market cues in the next week to know the domestic market trend. The economic data that may impact the global stock market next week are given below

| Important Global Macro Data Next Week | ||

| 23 Feb 2021 | Unemployment rate | GB |

| 25 Feb 2021 | GDP growth rate estimate | US |

| 25 Feb 2021 | Initial Jobless claim | US |

| 26 Feb 2021 | Tokyo CPI, Industrial production | Japan |

| 26 Feb 2021 | Personal Income and Spending | US |

FII & DIIs investment in Indian stock markets

FIIs were the buyers and DIIs were the seller in the cash market during the week. On a weekly basis, FIIs bought Rs 4408.26 crores while DIIs sold Rs 6283.78 crores in the cash market segment.

So far Indian stock market made an upward journey with the support of a strong FIIs inflow. Last week though FIIs were buyers in the cash market but the fund inflow has reduced compared to the previous week. Traders need to monitor the FIIs and DIIs cash market investment to know the market trend

Coronavirus risk & Vaccination

India reports around 14K fresh Coronavirus cases and 101 deaths in the last 24 hrs. The active coronavirus cases have risen to 143127 at present. A sudden spike was seen in Maharashtra in the last week. The state recorded 6112 new cases in the last 24 hrs, the highest single-day spike in over three months.

The state government has started reimposing restrictions in the hotspots particularly in the Vidharba districts of Maharashtra where new cases were found. According to the union health ministry, India has vaccinated more than 1 crore people so far which is almost 50% of the 2.15 cr plus doses supplied to the states that have been used so far.

Traders need to follow the recent spike of fresh coronavirus cases and restrictions because the rising coronavirus cases could washout the upward journey of the markets.

Crude oil price

The petro and diesel prices in the country have sharply increased after the latest round of fuel price hike by oil marketing companies (OMCs). Experts have said the continuous increase in fuel prices has started impacting people and the overall Indian economy. The prices of many commodities are expected to go up due to rising fuel costs. We may also see a rise in inflation too, which is not good for the Indian economy.

The hike in fuel price is due to the continuous rise in international crude oil prices. The global crude oil prices have been increasing after the Organisation of the Petroleum Exporting Countries (OPEC) plus decided to continue supply curbs. India is the third-largest importer of crude oil in the world, the recent increase of international crude oil prices has severely impacted India.

Though on Friday there was some relief in the crude oil prices, still Brent Crude price is trading at $62.72 per barrel. Traders should closely monitor the crude oil prices next week, the increasing fuel prices can trigger a correction in the domestic equity market.

You can also read daily morning market updates before the markets get open and Nifty and Bank Nifty futures predictions on daily basis.

You may also like to read, Intraday Trading books to make money from Stock Markets

Happy Investing!!

Editor’s Desk

Disclaimer-

Nifty50Stocks.com has taken due care and caution to compile the data for its Website. The views and investment tips expressed by investment experts on Nifty50Stocks.com are their own and only for educational purposes. Nifty50Stocks.com is not SEBI registered Advisors and advises its users to check with certified and SEBI registered experts before taking any investment decision. However, Nifty50Stocks.com does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or the results obtained from the use of such information. Nifty50Stocks.com especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.