Market Updates: Why the Nifty 326 pts down today?

Nifty at 10806, Sensex tanks 1115 pts, Why the market down today?

Why the market down today: Indian market opened gap down today as the cues from the US and Asian markets were negative. The markets traded negatively throughout the day and later extended their losses in the second half. The market closed lower for the sixth consecutive day today.

Bears are holding a tight grip on the markets today. In line with the larger peers, the broader indices were also under pressure. The main reason why the market was down today due to negative cues from the other Asian markets in the morning. The domestic sentiments remained negative as coronavirus cases are increasing and touching new high on daily basis.

Meanwhile, the global rating agency S&P Global rating has said that the Indian banking systems will see a slower recovery to the 2019 levels and the full recovery will not be possible before 2013.

On the global front, other Asian markets were down even after Thailand’s Central Bank left its key rate unchanged at a record low on Wednesday to support the economic recovery. The European markets are down today as the absence of fresh fiscal stimulus for the US economy and the second wave of coronavirus fears of slowing global economy. The US Dow Jones futures and Nasdaq futures are also trading marginally lower today.

Why the market down near 3 percent today

At the close, the market was down almost 3 percent today, except for HUL, ZEE, and Bharti Infratel, all other Nifty 50 stocks closed in the red. All sectors were under pressure and some heavyweight stocks fell more than 5 percent today.

In the end, Nifty was down today by 326.30 points or 2.93% and at 10805.55 levels while Sensex declined 1114.82 points or 2.95% and closed at 36553.60. The Bank Nifty on the spot levels also tanks 721.65 points or 3.40% and ended at 20456.85 levels.

The Nifty midcap and smallcap 100 indices also closed in deep red. The midcap index fell by 413.65 points or 2.51% and closed at 16039.80 levels. The Nifty smallcap index down by 145.50 points or 2.57% and ended at 5512.05 levels.

The top gainers in the Nifty index for the day are HUL, Bharti Infratel, and Zee Entertainment. The Bharti Infratel and Zee Entertainment will not be in the Nifty50 index from tomorrow, Divi’s Lab and SBI life will replace the two stocks from tomorrow. The top losers are IndusInd Bank, Bajaj Finance, Tata Motors, M&M, and TCS. The most active stocks in NSE for the day were Reliance, Dr. Reddy’s Lab, and TCS.

On a sectoral front, all major sectors were down today. Automobiles, Banking & Finance, Metals, IT & Software, and Oil & Gas closed in the deep red today.

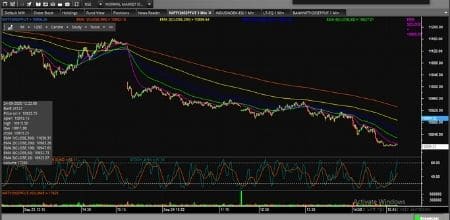

Nifty & Bank Nifty futures price movement on expiry day

The Nifty futures price opened at 11012.90, and it made a gap down opening of 134.75 points today. It has touched an intraday high at 11020 and a day’s low at 10800

The Nifty futures price has given a movement of 220 points. In the end, it declined 341.4 points or 3.06% and closed at 10806.25 levels.

The Bank Nifty futures price opened at 20931.15 It was made a negative opening of 309.2 points. It has touched an intraday high at 20979.80 and a day’s low at 20442.50

During the day, the Bank Nifty futures price has given a movement of 537.3 points. In the end, it was down by 785.25 points or 3.70% and closed at 20455.10 levels

Nifty, Bank Nifty futures prediction for 25th Sept ( Oct Expiry)

Nifty futures prediction for 25th Sept 2020

Primary Nifty Trend in futures: Negative

Range-Bound Trend of Nifty Futures: All up Moves Initiates Profit Booking (Sale) @ 10900 whereas All Down Moves Initiates Short Covering (Buy) @ 10750

If the Nifty futures share price Moves Above 10908 and sustain. Then you should Buy with 1st Target of 10940 during the day with a Stop Loss of 10824. FOR the Target of 10940- 10974- 11018

If the Nifty futures share price Moves Below 10824 and sustain. Then you should Sell with 1st Target of 10785 during the day with a Stop Loss of 10908. FOR the Target of 10785- 10756 -10730

Bank Nifty futures prediction, 25th Sept 2020

Primary Trend of Bank Nifty Futures: Negative

Range-Bound Trend of Bank Nifty Future: All up Moves Initiates Profit Booking (Sale) @ 20760, whereas All Down Moves Initiates Short Covering (Buy) @ 20100

If Bank Nifty futures share price Moves Above 20662 and sustain. Then you should Buy with 1st Target of 20760 during the day with a Stop Loss of 20340. FOR the Target of 20760 – 20850- 22018

If Bank Nifty futures share price Moves Below 20340 and sustained. Then you should Sell with 1st Target of 20245 during the day with a Stop Loss of 21480. FOR the Target of 20245 – 20130- 19900

Conclusions:

Indian markets closed negative for the sixth consecutive days today. The reason why the market was down today mainly for weak global cues, uncertainty on economic recovery, the second wave of coronavirus, and on domestic front monthly derivative expiry. After the profit booking in US technology share today the domestic IT sectors plunged more than 4 percent.

FIIs turned sellers in the last two days sold around Rs 6000 crores in the cash segment, indicates some selling pressure is yet to come in the Indian markets in the coming days. Traders should remain cautious and trade with strict stop loss tomorrow. You can also follow our Nifty and Bank Nifty futures prediction for 25th Sept.

You can check out the latest charting platform for your strategy here

Also read, Algo Trading Definition: Pros and Cons of Algorithmic trading

Nifty & Bank Nifty futures trading view ahead of F&O expiry

If you like the post please share with your friends and others

Happy Investing!

Editor’s Desk

Disclaimer-

Nifty50Stocks.com has taken due care and caution to compile the data for its Website. The views and investment tips expressed by investment experts on Nifty50Stocks.com are their own and not that of the website or its management. Nifty50Stocks.com is not SEBI registered Advisors and advises its users to check with certified and SEBI registered experts before taking any investment decision. However, Nifty50Stocks.com does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or the results obtained from the use of such information. Nifty50Stocks.com especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.