PSU Bank Merger: Know which stocks to buy now

The Finance Minister Nirmala Sitharaman recently announced the Public Sector Undertakings (PSU) Bank mega-merger plan of ten PSU Banks into four. It is one of the biggest merger plans of all-time in India. Let us first understand what is a merger.

What is a merger?

A merger is a consolidation of two entities into one legal entity. It is basically the consolidation of assets and liabilities of one or two entities under one entity where one survives and the other loses its corporate existence. In simple terms, the merger is a combination of two or more businesses into one business.

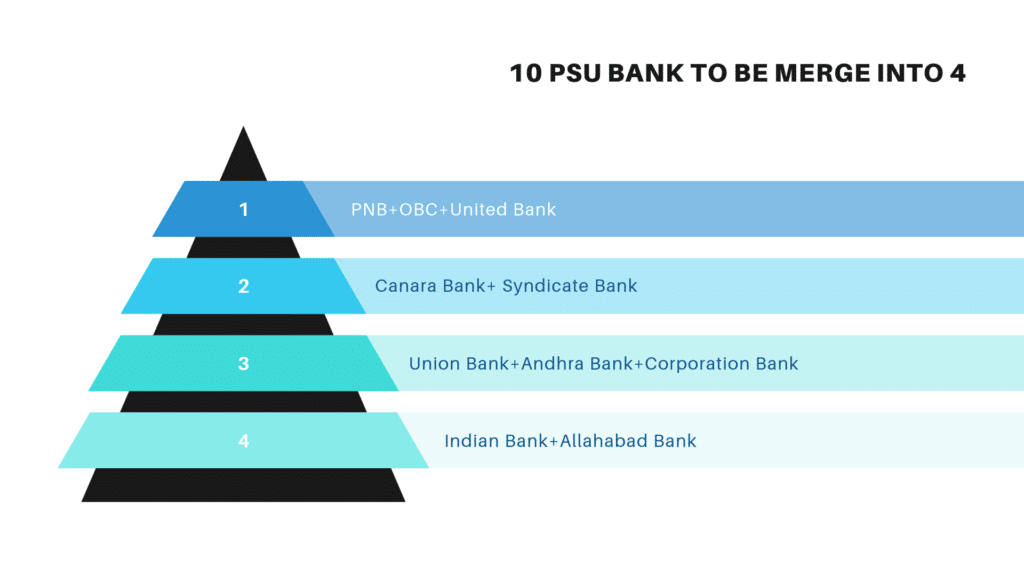

The Recent 10 PSU Bank merger news

After the smooth merger of SBI with its five associates of almost two years ago, the government had merged Vijaya Bank, Dena Bank and Bank of Baroda last April. The government is now confident for mega-merger of 10 PSU Bank to 4 in this financial year.

The Bank of Baroda posted a profit after the merger, net profit in the first quarter (April-June) period recorded at Rs 710 cr compared to a net loss of Rs 49 cr in the year-ago period. The Bank of Baroda had also reported an increase of Net Interest Income (NII) and Operating Income of the post-merger quarter.

The recent announcement of the PSU Bank merger came when the economy is at the slowest pace of 6 years. The PSU banks which were in bad shape in two years back, now it is almost back on track after taking measures in NPAs. The PSU Bank merger has been on the agenda for many years and the announcement has come exactly when it actually required.

At present, there are a total of 18 Public Sector Undertaking (PSU) Banks in India. After the Government’s announcement of 10 PSU Banks merger into 4 there will be a total of 12 PSU banks on post-merger. The list of a total of 18 PSU Banks with government shareholding percentage is as follows:

PSU Bank Share Price

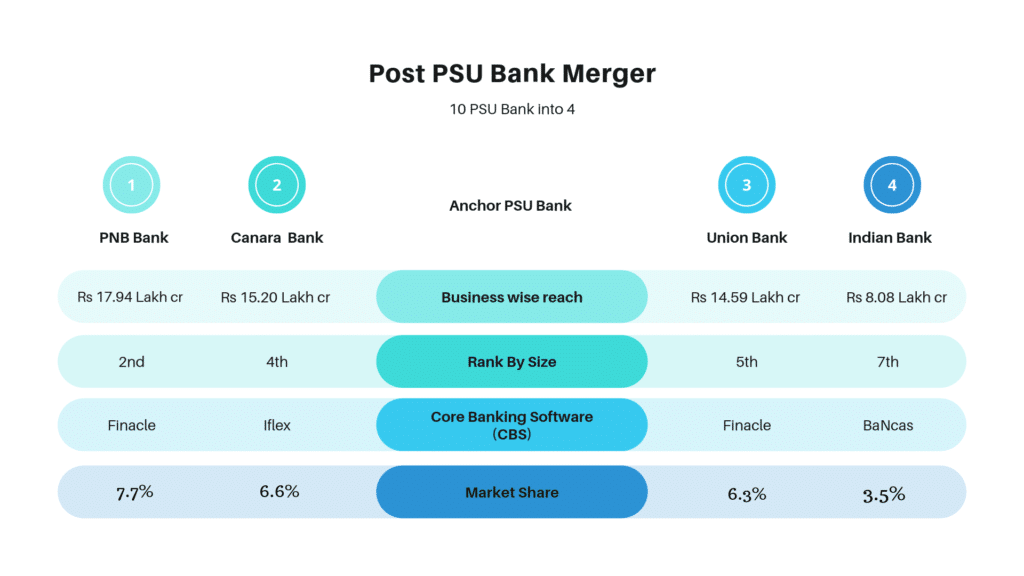

Most of the PSU banks are trading near an all-time low. After the news of the press conference by Finance minister for PSU Bank consolidation, a decent rally in the PSU Banking sector was seen ahead of the announcement. The share price of PSU banks particularly anchor banks like PNB, Canara, Union, and Indian Banks fell sharply after the news.

The anchor PSU banks fell around 5% to 7% on the next trading session after the news. It is also expected to fall further on the fear that management focus on NPA and growth may change to the merger or new integration. The government has also announced the capital infusion of Rs 55,000 cr out of Rs70,000 to these 10 state-run banks for smooth running.

Post Merger of PSU Banks

The PSU Bank merger is a huge positive for the long term in the banking sector but for a short term perspective it may not give the immediate result. Post-merger we may also see the rerating of few banks or even inclusion in Nifty50 in the long term.

The recent announcement of the PSU Bank merger came when the economy is at the slowest pace of 6 years. The PSU banks which were in bad shape in two years back, now it is almost back on track after taking measures in NPAs. The PSU Bank merger has been on the agenda for many years and the announcement has come exactly when it actually required.

Pros and Cons of PSU Bank Merger

The biggest positive of these mergers is that it would increase CASA growth, reduce the cost to income ratio, will help to cut operating expenses and boost the efficiency of the employee. On the negative front, the merger may increase the provision of anchor banks or may require time to handle the existing NPAs.

In the last Budget, the government has set a target to achieve a $5 trillion economy and banking reforms are a part of it. The PSU Bank merger will play an important role to improve credit offtake and revive the Indian economy.

In order to run the PSU Bank as a professional outfit, the Finance Minister Nirmala Sitharaman has announced that each PSU Bank will have a non-executive chairman. The PSU Banks will also have four executive directors’ specialization in technology.

The board of the bank will now be allowed to appoint a chief risk officer from the market. The risk office would be paid market-linked compensation to get the best talent from the market. The new recruitment, training, performance-linked compensation, performance appraisal will definitely strengthen the PSU Banks from hereafter.

PSU Bank Index

The Nifty PSU Bank Index comprises a maximum of 12 companies and its performance listed on the National Stock Exchange (NSE). The index is computed using the free-float market capitalization method. Whereas the level of the index reflects the total free-float market value of all the stocks in the index relative to a particular base market capitalization value.

The Nifty PSU Bank index is now trading at 3 years low, with around 20% negative return on a yearly basis. Since its inception ie 2004 Nifty PSU Bank index has given a very negligible return compared to other Nifty Index. The State Bank of India is the maximum weightage PSU Bank in the Index with 29.73%. The list of top constituents by weightage in PSU Bank index is:

| Top 10 PSU Bank Constituents by Weightage | |

| PSU Banks | Weightage % |

| State Bank of India | 29.73 |

| Bank of Baroda | 19.85 |

| Punjab National Bank | 12.35 |

| Canara Bank | 10.93 |

| Union Bank of India | 5.56 |

| Bank Of India | 4.71 |

| Indian Bank | 4.55 |

| Syndicate Bank | 2.96 |

| Oriental Bank of Commerce | 2.70 |

| Allahabad Bank | 2.56 |

PSU Bank in Bank Nifty

Bank Nifty consists of both Private and Public Sector Undertakings has given a return of multiple times since inception. There are only three PSU Banks which contribute to the Bank Nifty weightage, State Bank of India ( 8.6%) Bank Of Baroda ( 1.25%) and Punjab National Bank (0.92%).

The PSU bank contributes only 10.77% of the total Bank Nifty hence it is not because of the mega-merger news we have seen the fall in Bank Nifty. The recent fall in Nifty, Bank nifty is because of economic slowdown and geopolitical issues. The merger news of PSU Banks will definitely reap good results in the long term.

Which PSU bank stocks to purchase now

PSU Banks are trading near an all-time low. The recent news of mega-merger of PSU Banks makes this sector positive for the long term perspective. We have selected three PSU Banks based on recent developments which investors can now start accumulating on phase-wise.

1.State Bank Of India :

State Bank of India’s weightage in PSU Banking index is 29.73%, Bank Nifty 8.6%, and NIfty 3.07% and it is our first choice. There is a turnaround in the last two quarters for SBI result.

The bank has posted a good Q1 number and reported healthy growth in advances and stable asset quality. State Bank of India has posted a net profit of Rs 2312 crore for the June quarter FY20 compared to a net loss of Rs of 4,875.9 crores in the corresponding quarter of FY19.

The gross non-performing assets came down 2.8% sequentially from Rs1.73 lakh crore in Q4FY19. The Bank’s NII was up and provision has come down compared to the previous quarter. Overall the Q1 result of State Bank of India has met the Analyst expectations in the last quarter.

The share price of State Bank of India is trading at Rs 274 per share. Investors can start accumulating State Bank Of India for medium to long term period to get 25-30% return.

2.Canara Bank

Canara Bank is the second choice in the PSU banking sector. The weightage of Canara Bank in PSU Bank Index is 10.93%. The state-owned bank will be merged with another south based bank Syndicate Bank. After merger Canara Bank will have a very good presence in the south.

The Bank has reported a 17.08% rise in its standalone net profit to Rs 329.07 cr for Q1FY20. Canara Bank also reported that the total income of the bank rose to Rs14,062.39 crore in Q1FY20 from Rs 13,192.46 cr in the same period last year. The Canara Bank earned an operating profit of Rs 2440.01 crore in the last quarter and its income from other sources also increased marginally.

The asset quality of the bank has improved, the gross non-performing assets of the bank declined to 8.77%. Net NPA also came down to 5.35% from 6.91%. In absolute value, the net NPAs came down to Rs 23,149.62 cr from Rs 26,693.50 cr in the same period last year. Overall Bank’s provision and contingencies also eased

On the business side, deposit and advances of the bank improved by 13% to Rs 10.59 lakh crore in Q1 FY20. Overall there is a very positive development seen the Q1 result of Canara Bank. The result has beats the streets estimates.

The share price of Canara Bank is trading at Rs 192 per share. The merger news may take some time to get the positive result but investors should start accumulating Canara Bank for the long term perspective to get 25-30% return in 18-24 months.

3.Punjab National Bank

Punjab National Bank (PNB) would the 2nd largest bank after the merger with Andhra bank and United bank. The banks’ weightage in PSU Bank index is 12.35% and Bank Nifty is 0.92%. After Nirav Modi’s case, we all know about the downfall of PNB for almost 18 months. During this period the share price of PNB fall from Rs 176 to Rs 58.45 and at present, it is trading near an all-time low.

PNB in Q1FY20 reported a profit of Rs1018.63 crore against loss of Rs 940 crore registered in the same quarter last year. The Analyst was expecting loss but PNB had made a big surprise with a good set of Q1 FY20 numbers.

The Bank provision and contingency numbers were dropped in Q1FY20. The gross non-performing assets increased to 16.49% against 15.50% in the previous quarter, it was 18.26% in the same quarter last year. Similarly, there is a marginal increase in net NPA in this quarter compared to last quarter.

The Net interest income (NII) declined to 11.73% on a yearly basis to Rs 4141.36 cr whereas it was Rs 4691.86 cr in the same quarter last year. The government has also announced to infuse Rs 16,000 crores capital to PNB for smooth and seamless merger process. The share price of PNB is currently trading at Rs 61.30 per share.

Recently after the news of merger and capital infusion, Moody, the global rating agency upgraded the outlook of PNB from ‘stable’ to ‘positive’.We suggest investors to start accumulating PNB at this level to get 50-60% return in 18-24 months.

Conclusions:

The PSU Banks were under pressure due to NPA’s, high provisions, low income since last 5-6 years. The government infused capital from time to time as an when required to survive the PSU Banks. The government also introduced strict law National Company Law Tribunal (NCLT) to reduce the burden of the stressed asset.

After taking some strict steps since the last one or two quarter there is some development seen in the PSU Banks. The recent announcement of mega-merger which was expected since long is a big positive move for the PSU Banks. Though in the short term may be one or two quarters we may not see any positive results but in the long run, we can see a positive outcome from the merger.

Please share your views about the post.

If you like the post please share with your friends and others

You can also read, Your Stock Broker will never say these Hidden Charges.

Indian Stock Market Outlook for September Series

Nifty50 Stocks list | Index | Share price

Happy Investing!

Editor

Disclaimer-Nifty50Stocks.com has taken due care and caution to compile the data for its Website. The views and investment tips expressed by investment experts on Nifty50Stocks.com are their own and not that of the website or its management. Nifty50Stocks.com is not SEBI registered Advisors and advises its users to check with certified and SEBI registered experts before taking any investment decision. However, Nifty50Stocks.com does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. Nifty50Stocks.com especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.