NSE Bank Nifty share price target for 23 March 2021

NSE Nifty & Bank Nifty share price target for 23 March

BSE/NSE Updates- Nifty and Bank Nifty share price target: Indian stock markets opened on a flat note in the morning amid mixed global cues. The key indices Sensex and Nifty traded below their neutral lines most of the day. In the end, markets were closed in the red on the back of selling in banking stocks.

The market sentiments were dented due to the resurgence of coronavirus cases, especially in some economically significant cities of Maharastra. Lockdown and restrictions imposed in those regions may impact the growth projections for FY22.

However, traders have overlooked RBI’s data that foreign portfolio investor’s (FPSs) inflow of $36 trillion in equities till 10 March in this fiscal. This is the highest since FY13. On the other hand, the net Foreign direct investment (FDIs) inflow also jumped to $44 billion till January end, up from $36.3 billion a year ago.

NSE indices on the spot level: Sensex, Nifty, and Bank Nifty

At the close, NSE Nifty was marginally down by 7.6 points or 0.05 percent and finished at 14736.40 levels. While BSE Sensex declined to 86.95 points or 0.17 percent and closed at 49771.29 levels. The NSE Bank Nifty share price on the spot levels slipped 558.15 points or 1.63 percent and ended at 33603.45.

The NSE Nifty midcap and smallcap indexes closed in the green today. The Nifty midcap index gained 190.85 points or 0.82 percent and closed at 23603.60 levels. The Nifty smallcap index closed marginally higher by 2.75 points or 0.03 percent.

The top five gainers in the Nifty50 index were Adani Ports, Britannia, TCS, Tech Mahindra, and Sun Pharma. The top five losers in the Nifty50 index were IndusInd Bank, Power Grid, ICICI Bank, Tata Motors, and HDFC Bank. The most active stocks for the day were Reliance, Tata Motors, and Adani Ports.

On the sectoral front, IT & Software, FMCG, Healthcare, Infrastructure, and Real Estate sectors closed higher today. On the losing side, Banking, Oil & Gas, Automobiles, Telecom, and Insurance sectors closed in the red today.

NSE Futures Indices today- Nifty & Bank Nifty

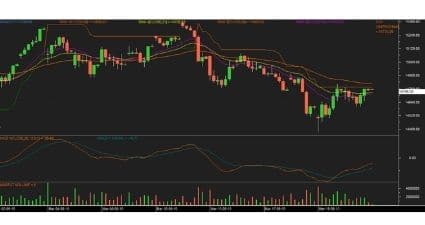

The NSE Nifty futures share price opened at 14741.05 made a negative opening of 15.4 points. It has touched an intraday high at 14779.90 and a day’s low at 14600

The Nifty futures share price has given a movement of 179.90 points. In the end, it closed almost flat at 14756 levels.

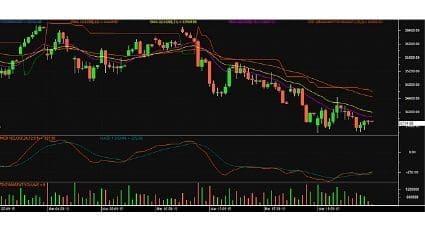

The NSE Bank Nifty futures share price opened at 34035.30 It made a negative opening of 170.3 points today. It has touched an intraday high at 34189.90 and a day’s low at 33413

During the day, the Bank Nifty futures share price has given a movement of 776.9 points. In the end, it declined 470.65 points or 1.38 percent and closed at 33734.95 levels.

NSE Nifty & Bank Nifty futures share price target for 23 March (March Expiry)

NSE Nifty futures share price target for 23 March 2021

Primary Nifty Trend in futures: Negative

Range-Bound Trend of Nifty Futures: All up Moves Initiates Profit Booking (Sale) @ 14850 whereas All Down Moves Initiates Short Covering (Buy) @ 14650

If the NSE Nifty futures share price Moves Above 14806 and sustain. Then you should Buy with 1st Target of 14830 during the day with a Stop Loss of 14712 FOR the Target of 14830-14858- 14890

If the NSE Nifty futures share price Moves Below 14712 and sustain. Then you should Sell with the 1st Target of 14680 during the day with a Stop Loss of 14806. FOR the Target of 14680- 14645 -14590

NSE Bank Nifty futures share price target for 23 March 2021

Primary Trend of Bank Nifty Futures: Negative

Range-Bound Trend of Bank Nifty Future: All up Moves Initiates Profit Booking (Sale) @ 33950, whereas All Down Moves Initiates Short Covering (Buy) @ 33200

Suppose NSE Bank nifty share price in futures Moves Above 33850 and sustain, then you should Buy with the 1st Target of 33980 during the day with a Stop Loss of 33570. FOR the Target of 33980 – 34145 – 34351

If NSE Bank nifty share price in the futures Moves Below 33570 and sustained, then you should Sell with the 1st Target of 33365 during the day with a Stop Loss of 33850. FOR the Target of 33365 – 33185 – 33000

Global markets today

On the global fronts, other Asian markets closed mostly in the red as sentiments were shaken by the US Fed Reserve after announcing that it would end some emergency measures that put in place last year to help the banking and financial institutions to deal with the pandemic. The European markets are trading almost flat at 5 pm IST. The investors are worried about more restrictions in the European countries due to rising coronavirus cases in the continent, but strength in automakers helped to limit the losses. The US future index, Dow future is trading flat whereas Nasdaq future index is trading higher.

Conclusions:

Indian stock markets closed almost flat to negative today. Traders/investors were concern about the weak global cues and fear of the second wave of coronavirus cases in India. The domestic market will remain volatile this week due to monthly expiry. Traders need to remain cautious ahead of the F&O expiry.

Traders/investors can follow our Daily Morning market views and can follow our NSE Nifty and Bank Nifty futures share price target for 23 March

Also read, Indian stock market trend for next week [ 22-26 March]

Best Options Trading Books in India-Must Read 2021

If you like the post please share it with your friends and others

Happy Investing!

Editor’s Desk

Disclaimer-

Nifty50Stocks.com has taken due care and caution to compile the data for its Website. The views and investment tips expressed by investment experts on Nifty50Stocks.com are their own and not that of the website or its management. Nifty50Stocks.com is not SEBI registered Advisors and advises its users to check with certified and SEBI registered experts before taking any investment decision. However, Nifty50Stocks.com does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or the results obtained from the use of such information. Nifty50Stocks.com especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.