Nifty & Bank Nifty Prediction for Tomorrow 29 June 2021

Nifty and Bank Nifty futures prediction for tomorrow 29 June 2021: Indian stock market indexes opened higher amid mixed cues global markets. The key benchmark indices erased all early gains and continued to trade in a pessimistic mode on account of selling in the blue-chip counters. In the end, market indexes closed marginally lower today.

The market sentiments were subdued as traders were worried about the spike in coronavirus cases in Asia. Australia’s most populous city of Sydney imposed restrictions after a cluster of cases involving the highly contagious Delta variant was reported. Though the fresh Covid-19 cases have declined in India, the Delta variant continues to be a cause of concern. States like Maharashtra continued their restrictions due to the concern about the Delta variant.

Traders were also worried as India Rating and Research (Ind-Ra) trimmed India’s GDP growth due to the speed and scale of the Covid-19 second wave.

Today’s market updates: Sensex, Nifty, and Bank Nifty spot price

At the close, Nifty fell 45.65 points or 0.28 percent and closed at 15814.70 levels while Sensex was down by 189.45 points or 0.35 percent and finished by 52735.59. The Bank Nifty spot price closed almost flat, down only 5.20 points or 0.01 percent, and ended at 35359.45 levels.

The broader markets outperformed the benchmark indexes today. The Nifty midcap index gained 141.50 points or 0.53 percent and closed at 27036.50. The Nifty smallcap index was up 35.40 points or 0.37 percent and finished at 9726.50.

The five gainers in the Nifty 50 index were Dr. Reddy’s Lab, Hindalco, Tata Steel, Divis Lab, and Tech Mahindra. The top five losers in the Nifty 50 index were HDFC Life, Titan Company, TCS, Shree Cement, and Coal India. The most active stocks in the Nifty 50 index were Reliance, Tata Steel, and SBI.

On a sectoral basis, Healthcare, Metals, PSU Bank, Consumer Durables, and FMCG sectors closed in the green. The sectors that closed in the red were IT and Software, Oil & Gas, Telecom, Insurance, and Finance.

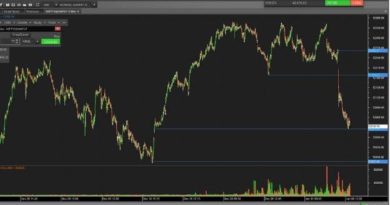

Nifty and Nifty Bank futures price movement for 28 June, ( July Expiry)

The Nifty futures price opened at 15921.15 and made a positive opening of 33.15 points. It has touched an intraday high at 15930 and a day’s low at 15825.45

The Nifty futures price has given a movement of 104.55 points today. In the end, it fell 26.35 points or 0.17 percent and ended at 15861.65 levels.

The Bank Nifty futures opened at 35698.95 It made a positive opening of 210.3 points today. It has touched an intraday high at 35990 and a day’s low at 35350

During the day, the Bank Nifty in futures has given a movement of 640 points. In the end, it closed higher by 54.9 points or 0.15 percent and closed at 35543.55 levels.

Nifty & Bank Nifty Prediction for Tomorrow 29 June, (July Expiry )

Nifty Futures Prediction for Tomorrow, 29 June

Primary Nifty Trend in futures: Positive

Range-Bound Trend of Nifty Futures: All up Moves Initiates Profit Booking (Sale) @ 15920 whereas All Down Moves Initiates Short Covering (Buy) @ 15830

If the Nifty futures share price Moves Above 15896 and sustain. Then you should Buy with 1st Target of 15920 during the day with a Stop Loss of 15838 FOR the Target of 15920-15948- 15976

If the Nifty futures share price Moves Below 15838 and sustained. Then you should Sell with the 1st Target of 15814 during the day with a Stop Loss of 15896. FOR the Target of 15814- 15790 -15760

Bank Nifty Prediction for Tomorrow, 29 June

Primary Trend of Bank Nifty Futures: Positive

Range-Bound Trend of Bank Nifty Future: All up Moves Initiates Profit Booking (Sale) @ 35900, whereas All Down Moves Initiates Short Covering (Buy) @ 35300

Suppose the Bank Nifty futures Moves Above 35630 and sustain, then you should Buy with the 1st Target of 35750 during the day with a Stop Loss of 35440. FOR the Target of 35750 – 35910 – 36085

If the Bank Nifty futures Moves Below 35440 and sustained, then you should Sell with the 1st Target of 35275 during the day with a Stop Loss of 35630. FOR the Target of 35275 – 35130 – 34980

Global markets today

On the global front, Asian markets mostly closed in the red due to the spike in coronavirus cases across the region over the weekend hurt investors’ sentiments. Hong Kong’s session truncated by severe weather in the city earlier in the day. Traders’ sentiments were also hurt after China’s industrial profits growth slows as per the latest report.

European market indexes are trading lower on persistent inflation worries and a fall in travel stocks due to a spike in Delta Variant of Covid-19 in the region. The US future indexes are trading mixed, the Dow future is trading marginally lower whereas Nasdaq future is trading higher at 5 pm IST.

Conclusions

Indian markets closed marginally lower on the first day of the week. The market opened on a firm note with the support of the global market cues but could not sustain at higher levels. Profit booking witnessed at the higher levels on frontline stocks whereas broader markets outperformed today.

Tomorrow, the domestic market will first react to the Finance Minister’s announcement that focused on boosting the economic recovery and supporting the vulnerable sectors and individuals that got hit by the second wave of Covid-19. You can also follow our Daily Morning Report and Nifty and Bank Nifty prediction for tomorrow June 29

Also read, Indian Stock Market Prediction Next Week (28 June-2 July)

Nifty Lot Size Reduced – Here’s what you should know

If you like the post please share it with your friends and others

Happy Investing!

Editor’s Desk

Disclaimer-

Nifty50Stocks.com has taken due care and caution to compile the data for its Website. The views and investment tips expressed by investment experts on Nifty50Stocks.com are their own and for educational purposes. Nifty50Stocks.com is not SEBI registered Advisors. Nifty50stocks.com advises its users to check with certified and SEBI registered experts before taking any investment decision. However, Nifty50Stocks.com does not guarantee the accuracy, adequacy, or completeness of any information. Nifty50stocks.com is not responsible for any errors or omissions or the results obtained from the use of such information. Nifty50Stocks.com especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.