Nifty & Bank Nifty futures price prediction for 29th Sept

Stock Market latest news, Nifty and Bank Nifty futures share price closed higher

Nifty & Bank Nifty futures price prediction for 29th Sept: It was a positive start for the Indian markets today as indicated by global cues in the morning. The markets gradually extended their early gains and closed in the positive zone for the second consecutive day. Almost all major sectors participated in the rally today and made a decent gain today.

The Indian market sentiments become positive after the Reserve Bank of India ( RBI) reported that bank credit rose by 5.26 percent to Rs 102.24 lakh crore. The bank deposit grew by 11.98 percent to 142.48 lakh crore in the fortnight ended 11 September. The bank advances were stood at 97.13 lakh crore and deposits reported at Rs 127.22 lakh crore for the fortnight ended 13 September.

The Reserve Bank of India has said that the Meeting of Monetary Policy Committee(MPC) has been rescheduled. The new dates will be announced soon.

On the global front, Asian markets closed higher after the news of the Chinese data boost. The European markets trading strong today after last week’s sell-off. The European markets got boosted by positive industrial profits data from China and buying interest in beaten-down banking stocks. The US market Dow and Nasdaq futures are trading higher today.

Sensex, Nifty, and Bank Nifty on spot levels.

At close, Nifty gained 177.30 points or 1.61% and at 11227.55 while Sensex was up by 592.97 points or 1.59% and closed at 37981.63 levels. The Bank Nifty on the spot levels gained 683.15 points or 3.26% and ended at 21665.50 levels.

The Nifty midcap and smallcap 100 indices also closed higher today. The Nifty midcap index gained 494.25 points or 2.99% and closed at 16998.25 levels. The smallcap index was closed higher by 202.6 points and ended at 5857.55 levels.

The top five gainers in the Nifty index for the day are IndusInd Bank, Bajaj Finance, Axis Bank, ONGC, and Tata Motors. On the losing side, HUL, Wipro, Nestle, and Infosys closed lower in the Nifty index today. The most active stocks in NSE for the day were Reliance, Bajaj Finance, and IndusInd Bank.

On a sectoral basis, almost all sectors closed in the green today. Automobiles, Banking & Finance, Healthcare, Capital Goods, Metals, and Infrastructure sectors closed 2-3% higher today.

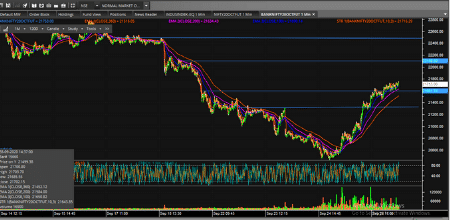

Nifty & Bank Nifty futures price today

The Nifty futures price opened at 11123.90, and it made a gap up opening of 81.70 points today. It has touched an intraday high at 11249 and a day’s low at 11090

The Nifty futures price has given a movement of 159 points. In the end, it gained 200.3 points or 1.81% and closed at 11242.50 levels.

The Bank Nifty futures price opened at 21100.10 It was made a positive opening of 120.90 points. It has touched an intraday high at 21765.90 and a day’s low at 21050

During the day, the Bank Nifty futures price has given a movement of 715.90 points. In the end, it gained by 773.35 points or 3.69% and closed at 21753 levels

Nifty, Bank Nifty futures share price prediction for 29th Sept ( Oct Expiry)

Nifty futures share price prediction for 29th Sept 2020

Primary Nifty Trend in futures: Positive

Range-Bound Trend of Nifty Futures: All up Moves Initiates Profit Booking (Sale) @ 11330 whereas All Down Moves Initiates Short Covering (Buy) @ 11170

If the Nifty futures share price Moves Above 11272 and sustain. Then you should Buy with 1st Target of 11294 during the day with a Stop Loss of 11194. FOR the Target of 11294- 11314- 11335

If the Nifty futures share price Moves Below 11194 and sustain. Then you should Sell with 1st Target of 11164 during the day with a Stop Loss of 11272. FOR the Target of 11164- 11138 -11085

Bank Nifty futures share price prediction, 29th Sept 2020

Primary Trend of Bank Nifty Futures: Positive

Range-Bound Trend of Bank Nifty Future: All up Moves Initiates Profit Booking (Sale) @ 22250, whereas All Down Moves Initiates Short Covering (Buy) @ 21550

If Bank Nifty futures share price Moves Above 21996 and sustain. Then you should Buy with 1st Target of 22118 during the day with a Stop Loss of 21520. FOR the Target of 22118 – 22240- 22480

If Bank Nifty futures share price Moves Below 21520 and sustained. Then you should Sell with 1st Target of 21400 during the day with a Stop Loss of 21996. FOR the Target of 21400 – 21280- 21040

Conclusions:

Indian market closed near the day’s high in a strong note. The support from the global market and hopes of fiscal stimulus ahead of the festive season has boosted the market sentiments. Though the increasing coronavirus cases in India and the European continent is a concern but markets completely ignored the issue and took support from the positive Chinese data.

RBI has postponed the Monetary Policy schedule date of 1st Oct, the new date will be announced soon. Traders should remain cautious with other macroeconomic data to be released this week.

You can check out the latest charting platform for your strategy here and also follow our Nifty and Bank Nifty futures price prediction for tomorrow 29th Sept

Also read, Algo Trading Definition: Pros and Cons of Algorithmic trading

Hedging: Meaning, Risk, Strategies, and types of Hedge

If you like the post please share with your friends and others

Happy Investing!

Editor’s Desk

Disclaimer-

Nifty50Stocks.com has taken due care and caution to compile the data for its Website. The views and investment tips expressed by investment experts on Nifty50Stocks.com are their own and not that of the website or its management. Nifty50Stocks.com is not SEBI registered Advisors and advises its users to check with certified and SEBI registered experts before taking any investment decision. However, Nifty50Stocks.com does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or the results obtained from the use of such information. Nifty50Stocks.com especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.