Intraday Trading Strategy-Nifty & Bank Nifty for 26 March

Intraday Trading Strategy for Nifty and Bank Nifty futures for 26 March April Series

Intraday Trading Strategy for tomorrow 26 March: Indian stock markets made a flat opening and immediately fell into the deep red in the morning today. The markets trimmed their early losses and traded volatile in the afternoon session. In the end, markets extended their yesterday’s losses and closed in the red.

The market sentiments were subdued with increasing risk arising from new coronavirus infections in India and the third wave in parts of Europe. The market sentiments remain down-beat even after Fitch Ratings in its latest report that revised India’s GDP growth estimates to 12.8 percent for the next fiscal year from its earlier estimates of 11 percent. It has also stated that India’s recovery from the depths of the lockdown-induced recession in 2020 ( calendar year) has been swifter than expected.

Stock market today- Nifty, Sensex, and Bank Nifty on the spot price

At close, Nifty fell 224.50 points or 1.54 percent and closed at 14324.90 levels while Sensex slipped 740.19 points or 1.50 percent and finished at 48440.12 levels. The Bank Nifty traded highly volatile today, it erased all morning losses in the second half and then closed 0.86 percent down in the end at 33006.45 levels.

The midcap and smallcap indices slipped more than 2 percent today. The Nifty midcap index was down by 476.40 points or 2.04 percent closed at 22858.55 levels. The Nifty smallcap index fell 174.45 points or 2.16 percent and ended at 7891.35 levels.

The top five gainers in the Nifty50 index were Tata Steel, ICICI Bank, DR. Reddy’s Lab, HDFC, and JSW Steel. The top five losers in the Nifty50 index were Maruti Suzuki, IOC, HUL, Coal India, and Hero Motor Corp. The most active stocks for the day were Tata Steel, Tata Motors, and SBI.

On the sectoral front, all sectors closed in the red today. The sectors that dragged down the markets were Automobiles, FMCG, Oil & Gas, IT & Software, and Banking & Finance.

NSE Futures Indices today- Nifty & Bank Nifty futures ( March Expiry)

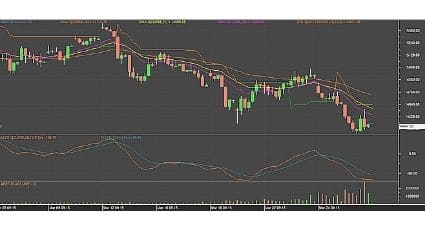

The Nifty futures share price opened at 14560 made a flat to the positive opening of 4.7 points. It has touched an intraday high at 14560 and a day’s low at 14261.25

The Nifty futures share price has given a movement of 298.75 points. In the end, it declined by 230.8 points or 1.59 percent and ended at 14324.50 levels.

The Bank Nifty futures share price opened at 33408.45 It made a positive opening of 50.15 points today. It has touched an intraday high at 33590 and a day’s low at 32391.65

During the day, the Bank Nifty futures share price has given a movement of 1198.35 points. In the end, it slipped 354.4 points or 1.06 percent and closed at 33003.90 levels.

Nifty & Bank Nifty intraday trading strategy, 26 March 2021 (April Expiry)

Nifty futures intraday trading strategy, 26 March 2021

Primary Nifty Trend in futures: Negative

Range-Bound Trend of Nifty Futures: All up Moves Initiates Profit Booking (Sale) @ 14530 whereas All Down Moves Initiates Short Covering (Buy) @ 14300

If the Nifty futures share price Moves Above 14484 and sustain. Then you should Buy with 1st Target of 14532 during the day with a Stop Loss of 14395 FOR the Target of 14532-14609- 14685

If the Nifty futures share price Moves Below 14395 and sustain. Then you should Sell with the 1st Target of 14316 during the day with a Stop Loss of 14484. FOR the Target of 14316- 14250 -14180

Bank Nifty futures intraday trading strategy 26 March 2021

Primary Trend of Bank Nifty Futures: Negative

Range-Bound Trend of Bank Nifty Future: All up Moves Initiates Profit Booking (Sale) @ 33650, whereas All Down Moves Initiates Short Covering (Buy) @ 32800

Suppose, Bank nifty share price in futures Moves Above 33455 and sustain, then you should Buy with the 1st Target of 33540 during the day with a Stop Loss of 33085. FOR the Target of 33540 – 33635 – 33820

If Bank nifty share price in the futures Moves Below 33085 and sustained, then you should Sell with the 1st Target of 32990 during the day with a Stop Loss of 33455. FOR the Target of 32990 – 32870 – 32618

Global markets today

On the global fronts, Asian markets mostly closed in the green today despite a selloff in Chinese technology shares due to concern about getting delisted from US bourses. The European markets are trading in the red as investors are worried about the rising third wave of coronavirus cases and its impact on economic growth. The US future indices, Dow and Nasdaq futures are trading marginally higher at this moment ( 5 pm IST)

Conclusions:

Heavy selling pressure was seen in the markets on the monthly F&O expiry day. Indian markets closed in the deep red for the second consecutive day due to weak global cues and the second wave of coronavirus in India. The key benchmark indices closed below their crucial levels today while midcap and smallcap stocks were worst hit.

Traders/investors can also follow our Daily Morning market views and trade on our Nifty and Bank Nifty intraday trading strategy, 26 March 2021

Also read, Stock market holidays 2021-Indian & Global markets

Best Options Trading Books in India-Must Read 2021

If you like the post please share it with your friends and others

Happy Investing!

Editor’s Desk

Disclaimer-

Nifty50Stocks.com has taken due care and caution to compile the data for its Website. The views and investment tips expressed by investment experts on Nifty50Stocks.com are their own. It is only for educational purposes. Nifty50Stocks.com is not SEBI registered Advisors. It advises its users to check with certified and SEBI registered experts before taking any investment decision. However, Nifty50Stocks.com does not guarantee the accuracy, adequacy, or completeness of any information. The website is not responsible for any errors or omissions or the results obtained from the use of such information. Nifty50Stocks.com especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.