Nifty, Bank Nifty futures trading strategy for 16 Oct

Market updates: Nifty, Bank Nifty futures trading strategy for 16 Oct.

Nifty & Bank Nifty futures Trading Strategy for 16 Oct: Indian equity markets opened in the positive territory amid negative global cues. Markets erased all early gains after a few minutes of trading in the morning and gradually extended their losses in the second half. In the end, the market finished in the negative territory and closed in the deep red.

The market sentiment was negative as traders were concerned with the International Monetary Fund (IMF) statement that India’s public debt ratio which remarkably remained stable at around 70% of the GDP since 1991, is likely to jump by 17% to nearly 90%. This is because of the increase in public spending due to COVID-19.

Director of the IMF’s Fiscal Affairs Department said as per their projection, the increase in public spending, in response to COVID-19, and the fall in tax revenues and economic activity will make public debt jump by 17% points to almost 90% of GDP. Weakness in the global markets also weighed on the domestic market today.

On the global front, Asian markets were closed in red as hopes of the U.S stimulus package before the Presidential election dimmed and a record number of new coronavirus infections in parts of Europe propelled investors towards safe- haven such as gold. European markets and US futures are also trading in the deep red today.

Sensex, Nifty, and Bank Nifty on the spot levels today

At the close, Nifty fell 290.70 points or 2.42% and at 11680.35 while Sensex tanks 1066.33 points or 2.61% and closed at 39728.41 levels. The Bank Nifty on the spot levels declined 802.25 points or 3.36% and ended at 23072.40.

The Nifty midcap and smallcap also closed in deep red today. The midcap fell 286.65 points or 1.70% and at 16599.60 levels. The Nifty smallcap index closed lower by 100.90 points and ended at 1.72% today.

The top gainers in the Nifty index for the day are Asian paints, JSW Steel, Hero Motorcorp, and Coal India. The top losers in the Nifty Index for the day are Bajaj Finance, Tech Mahindra, IndusInd Bank, ICICI Bank, and SBI. The most active stocks in NSE for the day are Infosys, Reliance, and TCS.

On a sectoral basis, almost all sectors closed in the red today. Banking & Finance, Oil & Gas, Healthcare, Metals, and Telecom sectors closed in the deep red today.

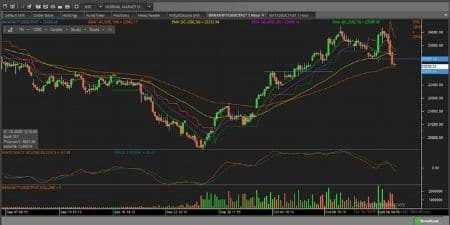

Nifty & Bank Nifty futures price today

The Nifty futures share price opened at 11983.90, it made a flat opening today, up 1.65 points only. It has touched an intraday high at 11999.35 and a day’s low at 11663.20

The Nifty futures share price has given a movement of 336.15 points. In the end, it declined 307.25 points or 2.56% and closed at 11675 levels.

The Bank Nifty futures share price opened at 23970 It was made a positive opening of 18.95 points today. It has touched an intraday high at 24140 and a day’s low at 22995.50.

During the day, the Bank Nifty futures share price has given a movement of 1144.5 points. In the end, it closed lower by 914.8 points or 3.82% and closed at 23036.25 levels.

Nifty and Bank Nifty futures trading strategy for 16th Oct. ( Oct Expiry)

Nifty futures trading strategy for 16 Oct 2020

Primary Nifty Trend in futures: Mild Negative

Range-Bound Trend of Nifty Futures: All up Moves Initiates Profit Booking (Sale) @ 11750 whereas All Down Moves Initiates Short Covering (Buy) @ 11600

If the Nifty futures share price Moves Above 11694 and sustain. Then you should Buy with 1st Target of 11730 during the day with a Stop Loss of 11620. FOR the Target of 11730- 11770- 11802

If the Nifty futures share price Moves Below 11620 and sustain. Then you should Sell with 1st Target of 11580 during the day with a Stop Loss of 11694. FOR the Target of 11580- 11558 -11504

Bank Nifty futures trading strategy, 16 Oct 2020

Primary Trend of Bank Nifty Futures: Mild Negative

Range-Bound Trend of Bank Nifty Future: All up Moves Initiates Profit Booking (Sale) @ 23200, whereas All Down Moves Initiates Short Covering (Buy) @ 22750

If Bank Nifty futures share price Moves Above 23335 and sustain. Then you should Buy with 1st Target of 23390 during the day with a Stop Loss of 22950. FOR the Target of 23390 – 23480- 23595

If the Bank Nifty futures share price Moves Below 22950 and sustained. Then you should Sell with 1st Target of 22820 during the day with a Stop Loss of 23335. FOR the Target of 22820 – 22750- 22640

Conclusions:

Profit booking was seen in the market after ten days of the rally. Indian markets fell sharply in the afternoon mainly because of weak global market cues. The delay in the US fiscal stimulus and the second wave of coronavirus cases in Europe are the two main reasons for the market fall. At this level, Nifty is looking slightly weak may touch the 11600 levels.

Traders can follow our Daily Morning market views and can follow our Nifty and Bank Nifty futures prediction for tomorrow 16 Oct.2020

Also read, Algo Trading Definition: Pros and Cons of Algorithmic trading

Infosys and Maruti share price target for next week

If you like the post please share with your friends and others

Happy Investing!

Editor’s Desk

Disclaimer-

Nifty50Stocks.com has taken due care and caution to compile the data for its Website. The views and investment tips expressed by investment experts on Nifty50Stocks.com are their own and not that of the website or its management. Nifty50Stocks.com is not SEBI registered Advisors and advises its users to check with certified and SEBI registered experts before taking any investment decision. However, Nifty50Stocks.com does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or the results obtained from the use of such information. Nifty50Stocks.com especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.